Statement of the Trustee

- Hannes Josef Antaszek

- Jan 18, 2023

- 7 min read

Hello dear Ephraim National Gold & Silver Trust community and interested parties.

The Ephraim National Gold & Silver Trust was formed in August 2020, around the same time that silver and gold made a new price high after years.

After that, gold and silver fell into a long sideways phase/correction with volatile moves.

The Trust has managed in this time until today to build up just under 180 kilograms of silver and just under 2 kilograms of gold, which in any case should be able to increase to a great extent, but this is already a great achievement of the Trust members, because it was possible to produce the Silver and Gold TempleCoin, the Silver TempleCoin now in the 2nd edition.

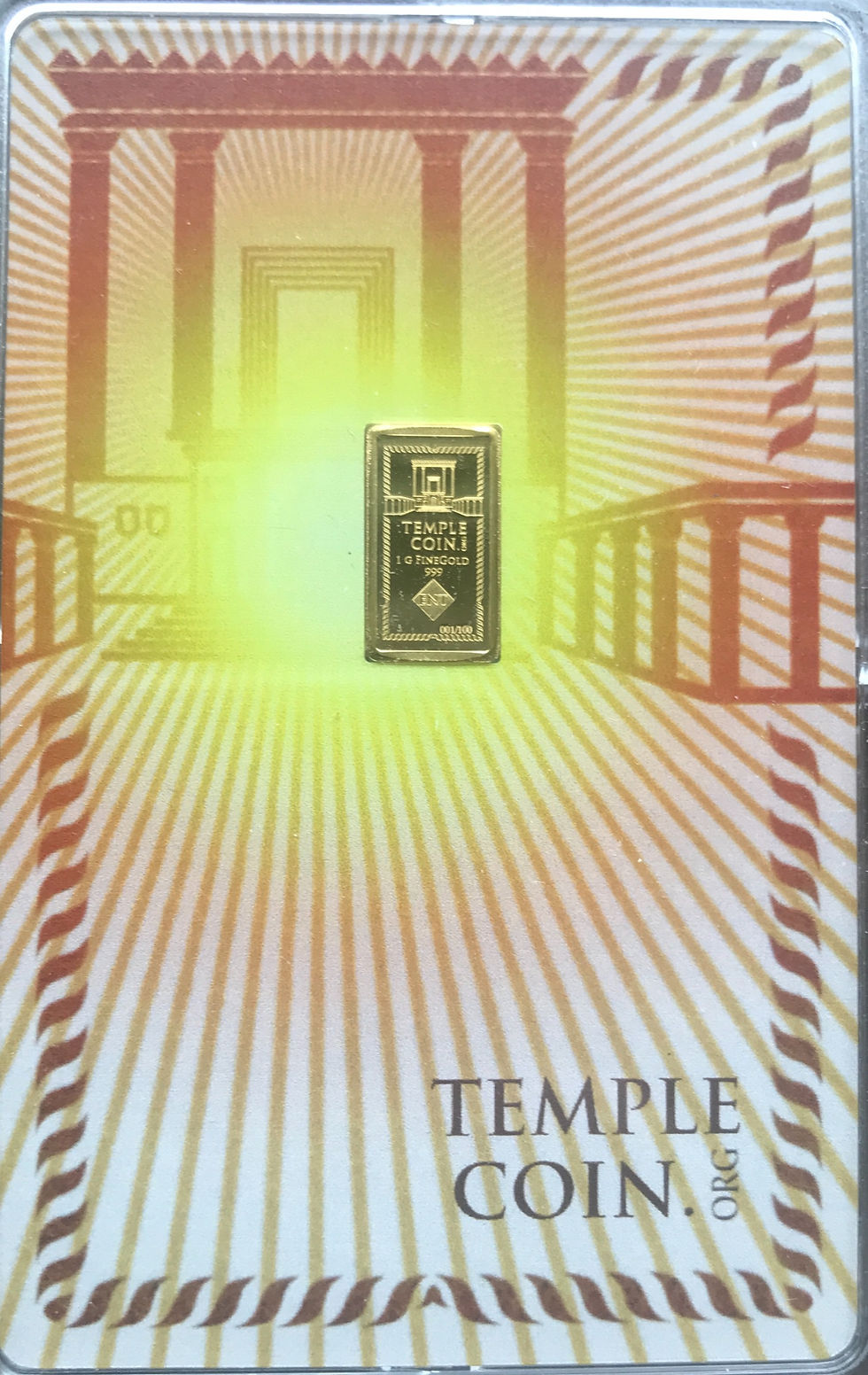

In addition, our well-known and chic 1 g GoldCard, a piece of Heavenly Jerusalem.

My efforts in building up the trust were especially in the first 2 years by the entanglement with many other issues with partly expensive costs and investments, which I partly financed from my private holdings of silver, which is why the timing of the purchase and sale of silver and gold became more important and more important for me, which is why I increasingly began to look at the current price in my activity as a trustee, after I had already lost a lot of money through incorrectly timed purchases and sales and here in principle there is a clear opportunity to achieve advantages by recognizing possible price movements with the right timing of planned purchases or sales. The bottom line is that I have not had much luck with these valuations to date, due to the accumulation of various errors, even if I recognized many movements partly correctly.

Moreover, it is obvious that these things 1.) are irrelevant for the normal investor, can even confuse him in parts, especially if the forecasts are poorly worked out and 2.) wrong forecasts can even cause additional damage, which is why an assessment of future prices according to technical analysis can be generally very dangerous.

In my current view, the strength of an analyst lies in recognizing trend changes early and drawing the appropriate conclusions from them, and it is precisely here that I have had difficulties since October/November in sufficiently detaching myself from my bearish view: The trend has become more bullish just in the last few weeks than I thought, even though I announced a possible high for gold in mid-December still at 1920 dollars, where we are right now. That the bearish forecast is still not off the table, however, even if gold and silver should continue to rise in the coming weeks and that even with a still new price high can still be considered a bear market rally, I come to that below.

Are we in the denial phase ("denial" yellow wave) with a pronounced bear market rally or have we already overcome the depression in gold and silver and are rushing to only new highs? der Leugnung ("Denial" gelbe Welle) mit einer ausgeprägten Bärenmarktrallye oder haben wir die Depression in Gold und Silber bereits überwunden und eilen zu nur noch neuen Hochs?

I have at any time also the problem that it is not quite easy for me, the on the one hand many information, which I take up each week concerning the gold silver market and process, for the TrustKunden in good form to present, while some information is possibly also irrelevant for the TrustKunden.

I try to bring together the most different analyses of different analysts in my articles, however, so far I have not managed to bring all this into a balance and I will try to keep future analyses a little more general and to reduce these to the more essential result, still more to concentrate on the info from the revelation for the historical time change relevant for us.

At the same time, however, it is always clear in my concrete reality that I am still forced to count on credit money until either a) the heir is appointed or b) we as a community manage to boost our own trade cycle to a greater extent and with more participants.

Here too, unfortunately, we have had some difficulties in the past, even though Ephraim in particular started out well (certifications of ounces, turning over stocks, in Sunday business meetings in various locations, trust companies, etc).

Where we are right now and were we are headed?

I am glad that some things have now cleared up a bit and we can continue to attack as a community to move our cause forward.

From a Trustee perspective, here are a few key things to focus on for now:

1.) I have finally launched the TempleCoin Certificates TOC with Ephraim, which will allow us to generate necessary investments for the Trust.

Among the main investments is the construction of our TempleCoin factory in Samaria, in which we have taken a big step forward with the new Torah government in Israel, but also planning new expenses, (eg for the new Ephraim Brigade or others) to allocate their costs or to finance other business expenses, such as diplomatic travel or basic administration, as it is becoming increasingly impossible to finance this from my private portfolio.

The first certificate issue of the TOC certificates is 6,000,000 in total at the price of 1 Euro investment plus the usual 1 gram silver cover plus 0.10 cent trust surcharge.

The initial sale is thus opened and every Trust customer can buy in the Trust Exchange.

If you are not yet a Trust customer, you can make your account here with existing Ephi ID card. If you are Jewish, then your Tudadseut is enough for us to make your account.

2) Soon Trust Council to operate future decisions and actions in the sense of the community more streamlined in the sense of unity and understanding.

3) The revival of the Ephraim National Gold&Silver course on Torahclub.com with a redesigned discussion group to bring more and more new people into our awesome system and grow together with our silver and gold trading system.

4) Possible completion of the merchandise management software to automate our gram based trading system and use it as an absolute top product.

Now again briefly an update on recent price developments:

Gold is now sitting at announced resistance in U.S. dollars. We have several possibilities for further price development. It may be that we have made the short-term top now. However, there is also the possibility of a New price high still this year, or even just a TripleTop, nevertheless, most of the analysts I value most point to a still lower low in gold at the latest thereafter, but this may not come until 2024.

Since I was clearly wrong here with the timing of this lower low and thus calculated much too fast and much too early, I would like to apologize here, even if other parts of the forecasts were correct.

Nevertheless, it is relieving that there are many indications that this lower low will still come and with it also perhaps the last opportunity to make final purchases at favorable purchase prices.

Of course, there is also the possibility that the price also totally breaks out to the top, also over the 2300 dollars and no longer comes back to the old lows, but I personally do not want to believe in it quite.

Which course of the lines shown by me now plays out, who knows that already, at least I observe the analyses of the colleagues very exactly, whether they work after Cycle theory, after ElliotWave or after simple CandleStick technology with supports and resistances. Almost 100% of these analysts have to adjust their forecasts themselves on a regular basis, because 1) things turn out differently and 2) than you think. I ask for your understanding that it is almost impossible for me to accurately convey all the information I have recorded here and therefore my statements sometimes remain inaccurate for the reader and I will try to improve this.

In the short term, correctly identified trends are capable of giving one a huge advantage and I will continue to try to convey any results here in an appealing manner if relevant.

For silver, it looks something like this now:

Silver is now also sitting at the announced resistance and has several possibilities.

The most extreme bullish variant could bring silver to even above 30 dollars this year, but even that is not certain. If the Weekly Cycle tops, silver can also quickly fall through to the downside. We know that silver is very volatile and it may well be that silver has now made the short-term top.

Again, we can still expect a lower low, no later than 2024.

The reason why I remain fundamentally bearish was covered in the last article, regarding the fundamental global recession.

Only an installation of Ephraim could practically change that in the short term, which is why we are working on it in parallel.

The typical trust client who wants to arm himself against the continuing loss of purchasing power of paper money should continue to buy REGULARLY in order to achieve at least an average price, as it is very difficult to hit the optimal buying opportunities. However, we will continue to try.

Basically, any of the current paper money prices are considered undervalued for the real value of gold and silver.

An appointment of the heir would then finally change the matter. The settlement would then be there for gold and silver. A further replenishment would perhaps not be covered for weeks and months and then the question arises quite concretely: How many grams do you have? How many trust certificates covered with physical grams do you have then?

Until then we have to live with these paper prices and everyone should take advantage of every one of these favorable paper prices. The purchasing power of gold and silver will explode sooner or later.

Thank you for your attention and I hope for lively exchanges.

Original TempleCoins, already recognized payment for the 12 Tribes Kingdom, anyone can order here:

In the Favour Package you get 30 Coins for only 390,- Euro!

Coins as a gift for the priest in gratitude for his work you can order here:

Your Coins to Israel we send here in further support of Rabbi Edery's great achievement:

留言